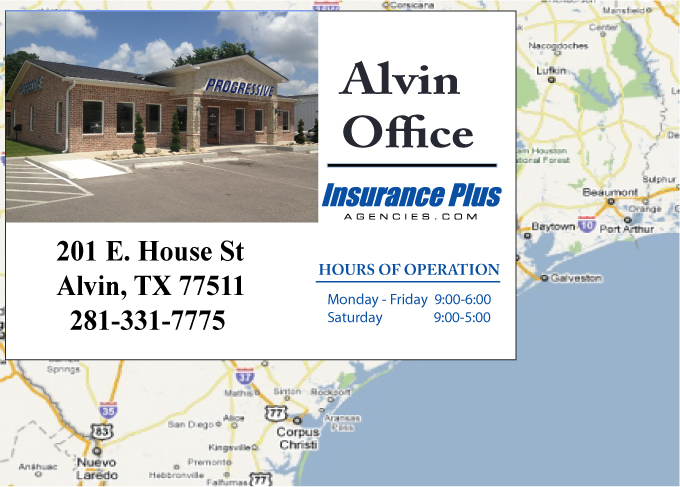

Call 281-331-7775 to quote & buy GEICO & Progressive Auto Insurance. Two Great Companies - One easy phone call!

Can I Get Car Insurance with No Down Payment?

If you’ve been searching for auto insurance and stumbled upon offers for “no down payment” car insurance, you’re not alone. Many drivers are drawn to these ads, hoping to secure coverage without paying anything upfront. However, the reality is that there’s no such thing as auto insurance with no down payment. Here’s why—and what you should know about getting affordable car insurance.

Why "No Down Payment" Car Insurance Isn’t Real

Insurance companies require an upfront payment to activate your policy. This payment, often referred to as a down payment, is essentially your first month's premium. It ensures that you have immediate coverage while the insurer assumes financial risk on your behalf.

While some insurers advertise "no down payment" policies, this terminology can be misleading. What they typically mean is that you may only need to pay the first month's premium without additional fees. However, you’ll still need to make an upfront payment to start the policy.

How Low Down Payment Car Insurance Works

Although true "no money down" car insurance isn’t an option, many insurers offer flexible payment plans that make coverage more accessible. These include:

-

Monthly Premiums: Instead of paying for six months or a year of coverage upfront, you can opt for monthly payments. This spreads out the cost over time, requiring only the first month’s premium to begin.

-

Pay-As-You-Go Insurance: Some insurers provide usage-based insurance plans where your premium is calculated based on how much you drive. These plans may offer lower upfront costs but still require some initial payment.

-

Discounts and Bundling: To reduce costs, look for discounts or consider bundling your car insurance with other policies like homeowners or renters insurance. This can help you lower the amount you pay initially and overall.

Be Cautious of Misleading Advertising

It’s essential to be wary of insurers using “no down payment” as a marketing gimmick. Reputable insurance companies will clearly outline their payment requirements and avoid making promises that sound too good to be true. Before signing up for a policy, read the fine print and understand exactly what payments are due and when.

Tips for Finding Affordable Car Insurance

If you're on a tight budget, here are some practical strategies to secure affordable coverage:

- Shop Around: Compare quotes from multiple insurers to find the best rate. Prices can vary significantly between companies.

- Maintain a Good Credit Score: In many states, your credit score can impact your insurance premium. A higher score can lead to lower rates.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premiums. Just ensure you can afford the deductible if you need to file a claim.

- Ask About Discounts: Many insurers offer discounts for safe driving, taking defensive driving courses, or having certain safety features in your vehicle.

The Bottom Line

While you can’t get car insurance without paying anything upfront, there are plenty of ways to manage costs and avoid financial strain. By understanding how car insurance payments work and exploring flexible payment options, you can find a policy that fits your budget without falling for misleading advertising.

When in doubt, work with a reputable insurance provider that prioritizes transparency and your peace of mind. After all, having reliable auto insurance is not just a legal requirement—it’s a crucial way to protect yourself and your vehicle.